Complete the details marked in the coloured text and leave everything else blank. Copy and paste your submission after the first pages as indicated. You are reminded of the University regulations on cheating. Except where the assessment is group-based, the final piece of work which is submitted must be your own work. Close similarity between submissions is likely to lead to an investigation for cheating. You must submit a file in an MSWord or equivalent format as tutors will use MSWord to provide feedback including, where appropriate, annotations in the text.

|

Student Name |

Pooja |

Reasonable Adjustments |

|

|

Student Number |

21163830 |

Check this box [x] if the Faculty has notified you that you are eligible for a Reasonable Adjustment (including additional time) in relation to the marking of this assessment. Please note that action may be taken under the University’s Student Disciplinary Procedure against any student making a false claim for Reasonable Adjustments. |

|

|

Course and Year |

MSc Management |

||

|

Module Code |

ACC7032 |

||

|

Module Title |

Managerial Finance |

||

|

Personal Tutor |

None |

||

|

First Marker Name: |

First Marker Signature: |

Date: |

|||

|

Feedback: General comments on the quality of the work, its successes and where it could be improved |

|||||

|

Provisional Uncapped Mark Marks will be capped if this was a late submission or resit assessment and may be moderated up or down by the examination board. |

|||||

|

% |

|||||

|

Feed Forward: How to apply the feedback to future submissions |

|||||

|

Quality and use of Standard English and Academic Conventions |

|||||

|

Spelling Errors |

Style is Colloquial |

Standard is a Cause for Concern |

|||

|

Grammatical Errors |

Inappropriate Structure |

If the box above has been ticked you should arrange a consultation with a member of staff from the Centre for Academic Success via Success@bcu.ac.uk |

|||

|

Punctuation Errors |

Inadequate Referencing |

||||

|

Moderation Comments (Please note that moderation is carried out through ‘sampling’. If this section is left blank, your work is not part of the sample.) |

|||||

|

Moderation is done via sampling. Your work was not part of the sample. |

|||||

|

Moderator Name: |

Moderator Signature: |

Date: |

|||

Table of Content

|

Content |

Sub Content |

|---|---|

|

1 |

1.1 Business Report for acquisition |

|

1.2 Working Capital Management |

|

|

1.3 Source of Finance |

|

|

2-a |

1.i Contribution per product |

|

1.ii Making Product Bass |

|

|

1.iii Making Product Cabinet |

|

|

1.iv Marginal Costing Techniques |

|

|

1.v Decision Making |

|

|

2-b |

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

References |

Answer 1

A financial services company based in the United Kingdom, Mars Holdings Plc Firm has subsidiaries in a variety of industries, including automobile dealerships and freight transportation, machinery production, as well as equipment leasing and finance, among others. Mars Holdings Plc Firm was founded in the United Kingdom in 1997. The company is presently attempting to acquire other firms to grow its list of subsidiary enterprises. In recent months, the corporation has targeted two businesses, known as WYRE CHILD SERVICES Ltd and BORDER Commercials Ltd, and the company has made takeover approaches to both.

In this instance, the two firms execute their activities in two different industries from one another. The establishment of WYRE CHILD SERVICES Ltd, which operates a hotel and provides care facilities for young people who do not have access to a vehicle at an early age, is the first major step. As a temporary measure, Mars Holdings Plc is open to exploring other options for a franchised hospitality service provider that is not presently active in the company. WYRE CHILD SERVICES Ltd is also looking forward to the acquisition of more properties in a variety of places around the United Kingdom, including London. While BORDER COMMERCIALS Ltd. primarily focuses on the supply of storage facility yards, it also owns a vehicle repair firm, which it uses for its operations. BORDER COMMERCIALS Ltd. has started to outsource many areas of their business to other persons, and they expect to continue to grow their operations in the future.

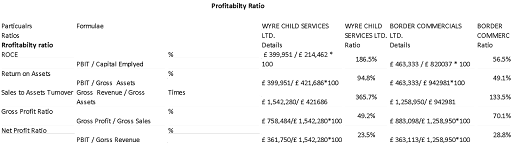

A variety of ratios for WYRE CHILD SERVICES Ltd. and BORDER Commercials Ltd. have been calculated and are shown in this box, which also contains a comprehensive ratio analysis for both firms. WYRE CHILD SERVICES Ltd.

1.1: Ratio analysis

Profitability Ratio:

Analysis:

We can see that the profitability ratio for WYRE CHILD SERVICES Ltd is much greater than the normal average when measured in terms of investment. Later, the BORDER COMMERCIALS Ltd. was established because of this decision. Even though the profit margin on sales is low, this may be because the profit margin ratios of the two companies are considerably different. For his or her part, the investor cares about his or her profit ratio, which has been calculated depending on the amount of money that has been invested. As a result, it has been suggested to the Board of Directors that investments in WYRE CHILD SERVICES Ltd. be preferred above investments in BORDER COMMERCIALS Ltd. because of this.

Activity Ratio:

Analysis :

We can also see that the total activity ratio of WYRE CHILD SERVICES Ltd. is higher than the overall activity ratio of BORDER COMMERCIALS Ltd. Therefore, it is advised that the Board invest in WYRE CHILD SERVICES Ltd rather than BORDER COMMERCIALS Ltd. because of this.

Liquidity Ratio:

Analysis :

The current ratio of WYRE CHILD SERVICES Ltd is lower than the current ratio of BORDER COMMERCIALS Ltd. The current ratio of WYRE CHILD SERVICES Ltd is lower than the current ratio of BORDER COMMERCIALS Ltd. However, as we all know, although an excessive increase in investments in the current ratio increases liquidity, it harms the long-term profitability of the business. According to this metric, WYRE CHILD SERVICES Ltd. outperforms BORDER COMMERCIALS Ltd. in terms of financial performance.

Analysis :

WYRE CHILD SERVICES Ltd. has a somewhat higher gearing ratio than BORDER COMMERCIALS Limited, suggesting that the firm is more exposed to risk than the latter. Despite this, the interest coverage ratio for WYRE CHILD SERVICES Ltd is much greater than the national average.

All the above analysis shows that the investment in the WYRE CHILD SERVICES Ltd as their subsidiary firm would result in more profits for Mars Holdings Plc since it is the more profitable investment choice than BORDER COMMERCIALS Ltd. The other parameters are also in the favour of the Wyre Child only.

Answer: 1.2: Working capital management

The following table summarises the conclusion, as well as the appraisal of the working capital for WYRE CHILD SERVICES Ltd and BORDER COMMERCIALS Ltd.

|

WYRE CHILD SERVICES LTD.( £ ) |

BORDER COMMERCIALS LTD. ( £ ) |

|

|

Particulars |

||

|

Current Assets |

417030 |

651435 |

|

Current Liabilities |

207224 |

122944 |

|

Liquid Assets |

417030 |

651435 |

|

Working Capital = CA- CL |

209806 |

528491 |

|

Current ratio |

2.01 |

5.30 |

|

Acid test ratio |

2.01 |

5.30 |

Analysis:

This table illustrates that the necessary working capital of BORDER COMMERCIALS Ltd. is £ 528,491, which is much more than the required working capital of WYRE CHILD SERVICES Ltd., which is £ 209,806 (as shown in the previous table). Increased liquidity, however, may result if the parent company puts more working capital behind BORDER COMMERCIALS Ltd., at the expense of a significant reduction in profit margins. WYRE CHILD SERVICES Ltd has a current working capital ratio of 2.01, which is almost the same as the company’s average working capital ratio. Despite this, the current ratio for other firms is 5.30, which is a very high figure. It is thus advised that working capital be assigned to WYRE CHILD SERVICES Ltd rather than BORDER COMMERCIAL LTD because of the above study. As a result of the analysis, we can conclude that the working capital management of Wyre Child Services ltd. is significantly better, and that the company is well-managed when compared to Border Commercials Ltd.

Answer 1.3: Recommended sources of finance

In the below box, two different finance sources for Mars Holdings Plc and their advantages along with the disadvantages are explained.

Table 3: Advantages and disadvantages of different sources of finance

|

Financial sources |

Benefit |

Limitation |

|

Ordinary Share Capital |

According to the preceding paragraph, it contributes to reducing the overall risk of the business, which increases when a firm invests via loan financing. When we get the finance through the ordinary share capital this will increase the share capital and no fixed commitments will be paid on the ordinary share capital. |

When equity financing is employed, the value of profits per share will decrease because of the financing is done using equity. Although it has the potential to reduce equity, which is associated with financial stability, it is not guaranteed to do so in practice. Because of these conditions, no investor will express an interest in making a financial investment in the company. When the value of the share drops, the increasing number of shares will influence most of the claim, resulting in a reduced playout for most of the claim. |

|

Because there are no set obligations for the interest that must be paid under equity finance, the company’s risk has not increased because of the financing. In this case, the firm only pays the dividend when the company makes a profit. |

When the ordinary shares are issued, the share capital will have to be shared with the other investors, and the other investors will also have to share with the board of directors if the board of directors determines that it is necessary based on their percentage holding of the company’s share capital. |

|

|

Debt Finance |

As soon as you exclude taxes from the total, you will find that debt financing rates are always cheaper than the expenses connected with equity financing. |

If the value of the company’s validity decreases, it can raise the financial risk associated with that decline. |

Answer: 2: Part a:

The specifics of the three items have been presented, and it is necessary to analyse those specifics, particularly concerning the two products that are not profitable and are incurring losses. The information has been given by AJ Supplies Ltd, which is responsible for the manufacture of the three goods. The following are the specifics of the computation, summarised as follows:

i: Contribution per unit has been computed following management accounting principles, and the following are the specific details:

|

Particulars |

Acoustic ( £ m) |

Bass ( £ m) |

Clarinet ( £ m) |

Total ( £ m) |

|

Sales |

360.00 |

240.00 |

180.00 |

780.00 |

|

COS – Cost of Sales |

||||

|

Cost of Material |

-120.00 |

-80.00 |

-80.00 |

-280.00 |

|

Cost of Labour |

-120.00 |

-120.00 |

-120.00 |

-360.00 |

|

Variable cost total |

-240.00 |

-200.00 |

-200.00 |

-640.00 |

|

Total contribution per product |

120.00 |

40.00 |

-20.00 |

140.00 |

|

Less: Gross Fixed Overheads |

-60.00 |

-60.00 |

-60.00 |

-180.00 |

|

Profits / – Loss |

60.00 |

-20.00 |

-80.00 |

-40.00 |

It has been estimated here what the Contribution per unit is, and we can see from the results of the computation that the Acoustic and Bass have a positive contribution, whilst the Clarinet has a negative contribution.

- According to management accounting tools and the notion of marginal costs, it has been indicated that we should continue producing the items that provide a positive contribution per unit of production. However, we should not continue to manufacture a product that does not make a good contribution. According to the results of these calculations, it has been advised that the corporation should continue to manufacture the two goods known as the Acoustic and the Bass, respectively.

iii. According to the detailed calculations and management accounting concepts, as well as the marginal costing, the product Clarinet is generating a negative contribution, and as a result, it has been recommended that the company discontinue the production of the product Clarinet to avoid further financial loss.

According to the marginal costing method, the variable costs include the cost of materials and the cost of labour. Furthermore, these expenses will be included in the computation of the contribution. Once the contribution has been computed, the overhead costs will be deducted from the contribution amount and reimbursed. The gift will be used to cover the costs of running the business. The notion of marginal costs is explained in more detail below. These expenses have been categorized as fixed and will be utilized as period costs in addition to being handled as a fixed expenditure. Thus, the donation will be utilized to cover the costs of operating the business.

- According to the calculations, the Bass will have to be constructed. If we stop producing the Bass, our losses will grow, and our earnings will decrease, depending on the situation. However, the product Clarinet will be phased out of production since the cessation of Clarinet manufacturing will raise the contribution, or, to put it another way, the contribution will not be reduced as a result of this. As a result, discontinuing the product Clarinet will boost the earnings of the corporation.

As a result, the continued production of the product Bass and the discontinuation of the production of the product Clarinet will improve the company’s earnings.

Answer Part 2(b)

- The cash flow statements, as well as the calculation of the net present value, have been completed, and the details have been summarised in the following way:

|

Particulars / Year |

0 |

1 |

2 |

3 |

|

Amount ( £ ) |

Amount ( £ ) |

Amount ( £ ) |

Amount ( £ ) |

|

|

Investment Cost |

||||

|

Cost of Land |

-4000.00 |

|||

|

Cost od Building |

-7900.00 |

|||

|

Cost of F & E |

-1830.00 |

|||

|

Gross Sales Revenue |

28600.00 |

29172.00 |

29755.44 |

|

|

Less: |

||||

|

Cost of Product acoustic |

-7900.00 |

-8058.00 |

-8219.16 |

|

|

Bass Stock Sold |

-5660.00 |

-5773.20 |

-5888.66 |

|

|

Cost of Staff |

-1180.00 |

-1203.60 |

-1227.67 |

|

|

Cost of Heating & Lighting |

-1676.00 |

-1709.52 |

-1743.71 |

|

|

Overhead’s cost |

-6424.00 |

-6552.48 |

-6683.53 |

|

|

Inflows of Cash |

5760.00 |

5875.20 |

5992.70 |

|

|

FCF = Free cash Flows |

-13730.00 |

5760.00 |

5875.20 |

5992.70 |

|

Present Value@ 12% |

1.00 |

0.89 |

0.80 |

0.71 |

|

Present Value |

-13730.00 |

5143.10 |

4683.71 |

4265.61 |

|

Net Present Value |

362.42 |

The NPV has been calculated and it is positive.

- Several factors have been considered in determining the payback time and discounting payback period, with the following results:

|

PBP = Payback Periods |

Amount ( £ ) |

Amount ( £ ) |

Amount ( £ ) |

Amount ( £ ) |

|

Particulars / Year |

0 |

1 |

2 |

3 |

|

FCF = Free cash Flows |

-13730.00 |

5760.00 |

5875.20 |

5992.70 |

|

Cash flows cumulative |

-13730.00 |

-7970.00 |

-2094.80 |

3897.90 |

|

PBP = Pay Back Periods |

2 Years |

0.35 |

2.35 Years |

The Discounted payback period has been as follows:

(iii ) Computed using the Excel formula, the internal rate of return has been described in detail below. The internal rate of return has been calculated using the following parameters:

(iv) In light of the calculations, it seems that the project has a 12 percent positive net present value (NPV). Nonetheless, it has been recommended that we include an additional 5% to account for inflation in our proposals. Additionally, we can observe that the project payback time is nearing the end. Even though the additional 5 percent coverage isn’t needed in this case, the project won’t be chosen because of the low IRR (only 13.52 percent) if it has been evaluated. The idea is thus doomed to failure, as I have calculated and determined via research.

- We’ve reviewed the limitations of the project assessment approaches stated above, and they are as follows: when we speak about the payback period, we don’t consider how much money is worth over time. In addition, we have seen that the fact that there is no tax has been taken into consideration. If the tax had been taken into consideration, the feasibility of the project would have been jeopardized. The third constraint of this project is that we need to add 5 percent to the cost of capital, while inflation has only grown by 2 percent because of the project’s implementation. As a result, we must recognize that there are certain concerns, such as the fact that the government is advising us to add 5 percent, even though the inflation rate has only grown by 2 percent. There are several limits linked with this project that has been identified, and these are the same restrictions that have been identified as the limitations of the PBB, NPV, and IRR.

Answer 3: a;

Revised budgeted Income statements

|

Revised Budget Proposals |

Amount ( £ ) |

|

Gross Sales |

1110000 |

|

Less: |

|

|

Material cost reduced by 8% |

-418600 |

|

Labour cost reduced by 2% |

-212160 |

|

Overhead variable reduced by 2% |

-159120 |

|

Fixed Overheads (add: 20000) |

-160000 |

|

Total Costs |

-949880 |

|

Net Profits |

160120 |

Revised Balance sheet

|

Revised Comprehensive Budgeted Net Assets |

||

|

Particulars |

Amount (£) |

Amount (£) |

|

NCA |

375,000 |

|

|

WC |

||

|

Account Receivables = 64 Days = 1110,000*64/360 |

197,333 |

|

|

Ending Inventory = 110,000 + 40,000 |

150,000 |

|

|

Account Payables = (50000 + 25000) |

– 75,000 |

|

|

NWC = Total Current Assets – Total Current Liability |

272,333 |

|

|

Net assets |

647,333 |

Working Notes:

|

Working: |

|||

|

Sales Budget revised |

|||

|

Budget Proposal revised |

Quantity |

Rates |

Total |

|

Gross sales |

10000 |

£ 30 |

£ 300,000 |

|

Existing Sales |

22500 |

£ 36 |

£ 810,000 |

|

Sales Total |

£ 1,110,000 |

||

|

Budget of Material cost |

|||

|

Material cost reduced by 8% |

32500 |

£ 12.88 |

-£ 418,600 |

|

Labour Cost budget |

|||

|

Labour cost reduced by 2% |

32500 |

-£ 6.5280 |

-£ 212,160 |

|

Variable Overhead budget |

|||

|

Variable Overheads inc.by 2% |

32500 |

-£ 4.896 |

-£ 159,120 |

|

Fixed Overhead Budget |

|||

|

Fixed Overheads (add: 20000) |

(140,000 + 20,000) |

-£ 160,000 |

|

- the effect on profit of the changes resulting from the proposal. The Contribution per unit and the total contribution has been calculated as follows:

|

Particulars |

Contribution per unit (£) |

Total Contribution (£) |

Net Profits (£) |

|

Budget Old |

10.80 |

270,000 |

130,000 |

|

Budgeted revised |

9.85 |

320,120 |

160,120 |

c. Due to the improved total profits, it has been recommended to the management that the new plan, which would boost both sales and total profits, should be implemented. The preceding calculation was performed for this reason, and the overall contribution, as well as the earnings, have grown as a result. As a result, it is preferable that the newly amended plan has been beneficial to the firm, and this will result in increased corporate earnings.

Further calculations may be necessary for this purpose, which will be done from the perspective of the qualitative elements. Because we are offering the same items at a different price or a lower price than our competitors, there is a possibility that this may cause problems in the market. As a result, we must guarantee that the product is offered under a new brand name and in different packaging and that it has been sold in a completely different market. Because of this, product differentiation must have been completed, in addition to market differentiation, which is necessary. The difference pricing will cause issues in the future if it is not addressed immediately.

Also necessary is the exploration of different markets to increase sales at a higher profit margin. This is one of the other things that must be done. The management team must also strive to bring the variable costs down as much as possible. As a result, these are the extra conditions that will be required before the bids may be accepted.

Reference list

Albanese, C., Crépey, S., Hoskinson, R. and Saadeddine, B., 2021. XVA analysis from the balance sheet. Quantitative finance, 21(1), pp.99-123.

Husain, T. and Sunardi, N., 2020. Firm’s Value Prediction Based on Profitability Ratios and Dividend Policy. Finance & Economics Review, 2(2), pp.13-26.

Myšková, R. and Hájek, P., 2017. Comprehensive assessment of firm financial performance using financial ratios and linguistic analysis of annual reports. Journal of International Studies, 10(4), pp. 15-30.

Simamora, R.A. and Hendarjatno, H., 2019. The effects of audit client tenure, audit lag, opinion shopping, liquidity ratio, and leverage to the going concern audit opinion. Asian Journal of Accounting Research.4(1),PP. 13-40.

Suzuki, D., 2019. Stock and flow in accounting. Balance sheet and income statement approaches. AMIS IAAER 2019, p.354.

Horal, L., Shyiko, V. and Yaroshenko, O., 2019, September. Modeling break-even zone using the integral methods. In 6th International Conference on Strategies, Models and Technologies of Economic Systems Management (SMTESM 2019) (pp. 172-176). Atlantis Press.